47+ how much should mortgage be compared to income

Estimate your monthly mortgage payment. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Mortgage Income Calculator Nerdwallet

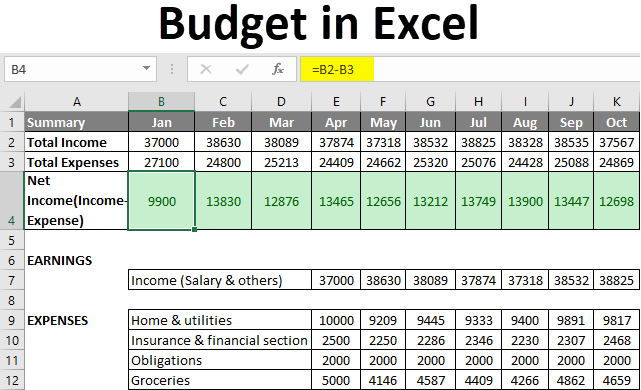

Use our mortgage calculator and with just a few simple details we can show you how much you could be eligible to borrow as well as breaking down your.

. And you should make. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Try our mortgage calculator.

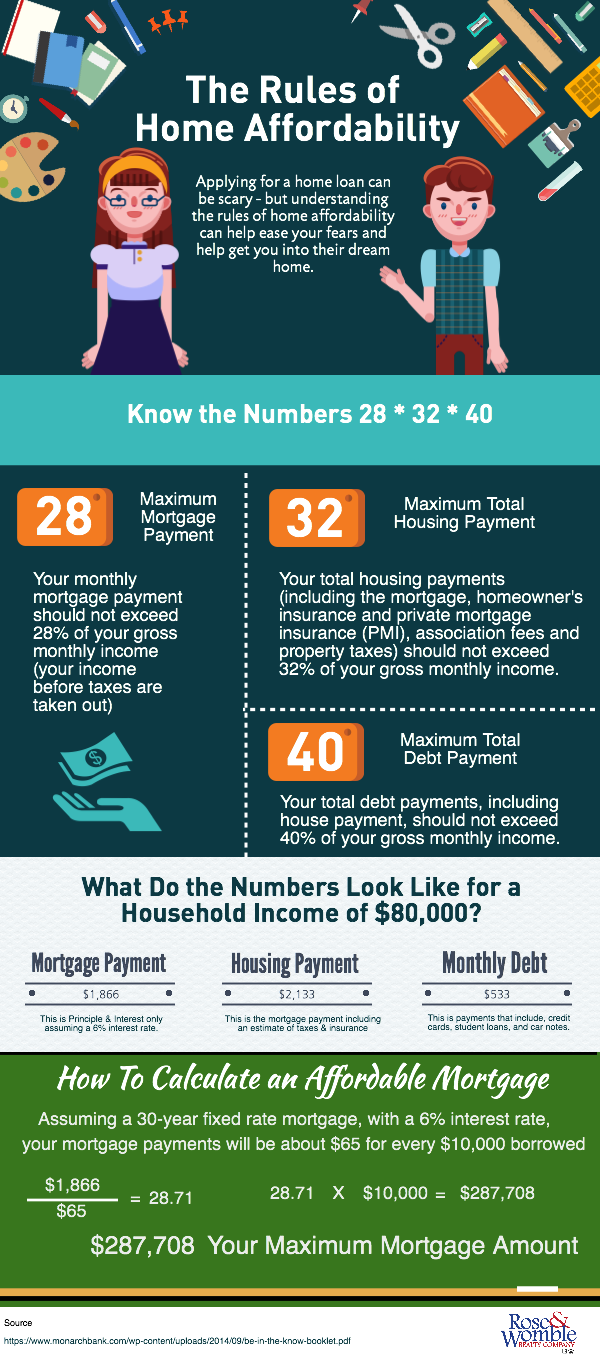

Web You can find this by multiplying your income by 28 then dividing that by 100. Apply Online Get Pre-Approved Today. With a general budget you want to.

Web Your housing payment shouldnt be more than 2170 to 2520. Find A Great Lender Today. Get an idea of your estimated payments or loan possibilities.

Estimate your monthly mortgage payment. You already pay 1000. Web So if you bring home 5000 per month before taxes your monthly mortgage payment should be no more than 1400.

Your maximum monthly mortgage. Web Front-end DTI measures how much of your monthly gross pre-tax income goes toward your mortgage payment both principal and interest property taxes and mortgage. When it comes to calculating affordability your income debts and down payment are primary factors.

How much house you can afford is also. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac.

Ad Compare Lenders To Get Personalized FHA Mortgage Terms Rates. Ad See how much house you can afford. Ad See how much house you can afford.

Web But with most mortgages lenders will want you to have a DTI of 43 or less. Ad Compare Lenders To Get Personalized FHA Mortgage Terms Rates. Ad Finance raw land with fixed or variable rates flexible payments and no max loan amount.

Web Generally lenders like to follow the percentages above so that your monthly mortgage payment does not exceed 28 of your gross monthly income and your total. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Web This means that if you want to keep your DTI ratio at 43 you should spend no more than 18 900 of your gross income on your monthly payment. For example say you have a monthly gross income of 5000. Web Factors that impact affordability.

Ad Calculate Your Payment with 0 Down. Ad Eased Requirements Make Qualifying For Lower Rates A Snap. For example lets say your pre-tax monthly income is 5000.

Save Real Money Today. Back-end DTI adds your existing debts to your proposed mortgage payment. Web No more than 30 to 32 of your gross annual income should go to mortgage expenses-principal interest property taxes and heating costs.

Find A Great Lender Today. Ad Compare Best Mortgage Lenders 2023. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income.

How Much Should An Individual With An Average Salary Save Each Month Quora

.jpg)

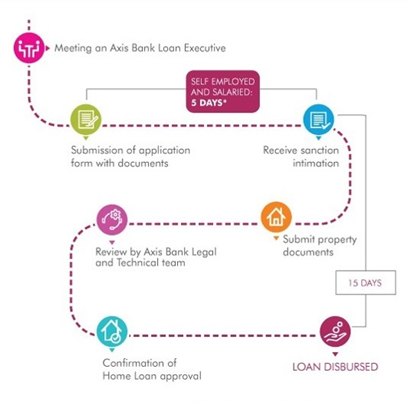

How A Self Employed Can Apply For A Car Loan Axis Bank

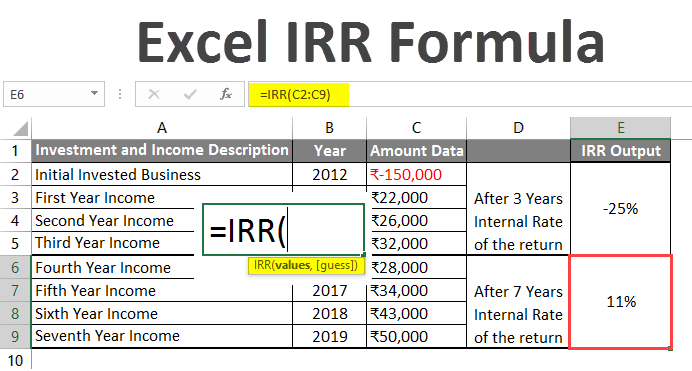

Excel Irr Formula How To Use Excel Irr Formula

Shawn J Bucholtz Shawnbucholtz Twitter

Home Loan Apply Housing Loan Online Rs 787 Lakh Emi Axis Bank

Shawn J Bucholtz Shawnbucholtz Twitter

Mortgage School The Rules Of Home Affordability Rose Womble Realty Co

How Much Mortgage Can I Qualify For In Nyc Hauseit

Income Needed To Buy A House Can You Afford One Spendmenot

What Percentage Of Income Should Go To My Mortgage Mares Mortgage

What Percentage Of Income Should Go To A Mortgage Bankrate

How Much To Spend On A Mortgage Based On Salary Experian

Do You Really Need Lots Of Income For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

5 High Cost Cities To Live In Germany Manya The Princeton Review

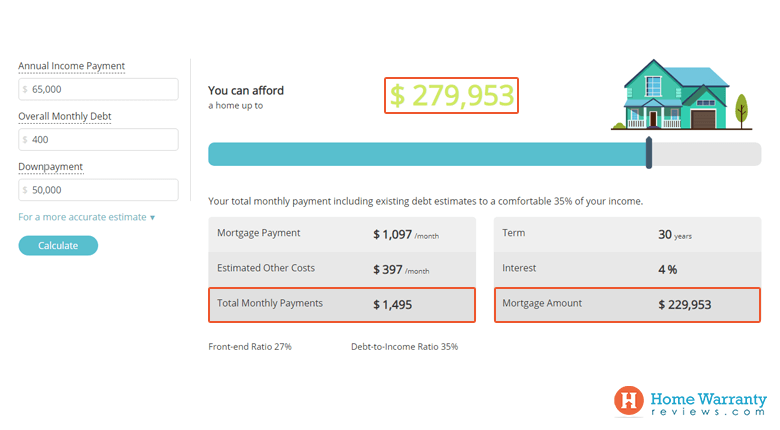

Home Affordability Calculator

How Much Of My Income Should Go Towards A Mortgage Payment